Key events Show key events only Please turn on JavaScript to use this feature

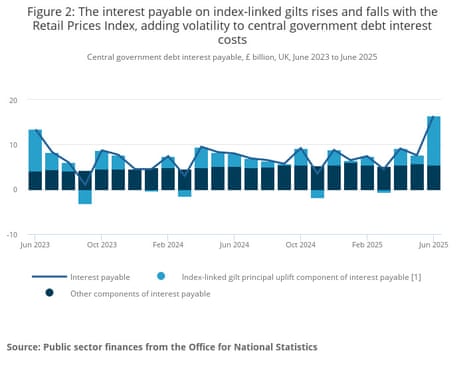

Interest payable on central government debt rose to £16.4bn in June

Most of the UK government’s borrowing last month was to service existing national debt.

The interest payable on central government debt more than doubled to £16.4bn in June 2025, £8.4bn more than in June 2024.

That’s £2.4bn more than the £14.0bn forecast by the Office for Budget Responsibility (OBR), and the second-highest for any June apart from in 2022.

The increase is driven by index-linked gilts, where the interest rate on the bonds rises and falls in line with the RPI measure of inflation.

UK borrowing jumps to £20.7bn in June

Newsflash: Britain borrowed more than expected last month, as the pressures on the public finances grow and debt interest costs rise.

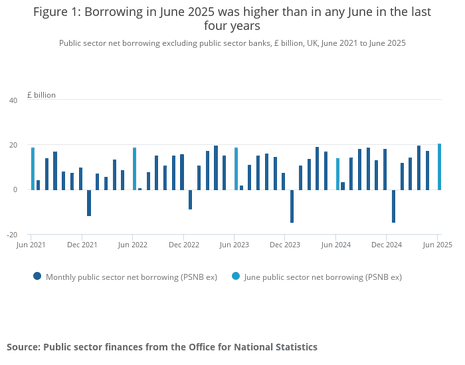

Borrowing jumped to £20.7bn in June 2025, some way over City forecasts for £16.5bn, which will add to the pressure on chancellor Rachel Reeves.

That’s £6.6bn more than in June 2024 and the second-highest June borrowing since monthly records began in 1993 (beaten only by June 2020, when the Covid-19 pandemic drove up government spending).

Worryingly for the chancellor, it’s also £3.5bn more than the £17.1bn forecast by the Office for Budget Responsibility, which may fuel speculation that the government will breach its fiscal rules unless it raises taxes or cuts spending.

The jump was partly driven by higher interest payments on the UK’s national debt, on bonds linked to inflation, which wiped out the recent increase in businesses taxes.

Public sector net borrowing excluding public sector banks was £20.7 billion in June 2025.

This was £6.6 billion more than in June 2024 and the second-highest June borrowing since monthly records began in 1993, behind that of June 2020.

Read more ➡️ https://t.co/WBro41C2I8 pic.twitter.com/vIH9h3r21D

ONS acting chief economist Richard Heys said:

“Borrowing in the month of June was over £6bn higher than during the same time last year.

“The rising costs of providing public services and a large rise this month in the interest payable on index-linked gilts pushed up overall spending more than the increases in income from taxes and National Insurance contributions, causing borrowing to rise in June.”

Concerns about the state of the public finances have been rising since the government rowed back on reforms to welfare spending after a revolt among its own MPs, a move that will eat into the chancellor’s fiscal headroom.

Glenn Youngkin, governor of the Commonwealth of Virginia, has cheered AstraZeneca’s decision to build its new multi-billion dollar drug substances plant in his state.

Youngkin, who appeared alongside AstraZeneca’s CEO Pascal Soriot at last night’s signing ceremony, says:

“I want to thank AstraZeneca for choosing Virginia as the cornerstone for this transformational investment in the United States. This project will set the standard for the latest technological advancements in pharmaceutical manufacturing, creating hundreds of highly skilled jobs and helping further strengthen the nation’s domestic supply chain.

Advanced manufacturing is at the heart of Virginia’s dynamic economy, so I am thrilled that AstraZeneca, one of the world’s leading pharmaceutical companies, plans to make their largest global manufacturing investment here in the Commonwealth.”

AstraZeneca's new US investment plans

Here’s where AstraZeneca plans to spend its $50bn:

-

Expansion of its R&D facility in Gaithersburg, Maryland

-

State-of-the-art R&D centre in Kendall Square, Cambridge, Massachusetts

-

Next-generation manufacturing facilities for cell therapy in Rockville, Maryland and Tarzana, California

-

Continuous manufacturing expansion in Mount Vernon, Indiana

-

Specialty manufacturing expansion in Coppell, Texas

-

New sites to supply clinical trials

Introduction: AstraZeneca unveils $50bn US investment

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

AstraZeneca has become the latest multinational company to announce a major investment in the US since Donald Trump began his trade wars.

AstraZeneca announced last night it will invest $50bn in the US by 2030, building new manufacturing facilities and expanding existing sites.

It says the plan – which has the seal of approval from the White House – will create tens of thousands of new, highly skilled direct and indirect jobs across America. It could also help AstraZeneca to reach a point where half its revenues are generated in the US.

The plan includes building a new drug substance facility in the Commonwealth of Virginia, which will produce small molecules, peptides and oligonucleotides. That would be AstraZeneca’s largest single manufacturing investment in the world.

The move comes as the pharmaceuticals industry braces for Trump to impose new tariffs on their wares entering the US, possibly as soon as 1 August.

Pascal Soriot, chief executive officer at AstraZeneca, says:

“Today’s announcement underpins our belief in America’s innovation in biopharmaceuticals and our commitment to the millions of patients who need our medicines in America and globally. It will also support our ambition to reach $80 billion in revenue by 2030.”

This investment splurge also comes amid reports that Soriot has been considering shifting AstraZeneca’s stock market listing from the UK to the US. AstraZeneca is currently the second most valuable company on the London stock exchange, shortly behind HSBC.

Howard Lutnick, US Secretary of Commerce, has welcomed the plan, saying:

“For decades Americans have been reliant on foreign supply of key pharmaceutical products. President Trump and our nation’s new tariff policies are focused on ending this structural weakness.

We are proud that AstraZeneca has made the decision to bring substantial pharmaceutical production to our shores. This historic investment is bringing tens of thousands of jobs to the US and will ensure medicine sold in our country is produced right here.”

The agenda

-

7am BST: UK public finances for June

-

10.15am BST: Bank of England governor Andrew Bailey to be grilled by Treasury committee MPs about financial deregulation

-

1.30pm BST: Fed chair Jerome Powell speech at the Integrated Review of the Capital Framework for Large Banks Conference, Washington, D.C.

-

2pm BST: Rachel Reeves to appear before Lords economics affairs committee

3 months ago

60

3 months ago

60