Russia’s economy is in deep peril, Donald Trump assured the world this week, in a dramatic change of tune on the war in Ukraine in which the US president claimed Kyiv now had a chance to win back all its territory.

The reality, economists say, is more complicated. While Moscow is enduring its toughest period since the chaotic first days of the invasion, few analysts believe its economy is on the brink of a total collapse, and fewer still expect Vladimir Putin to adjust his war plans in the short term.

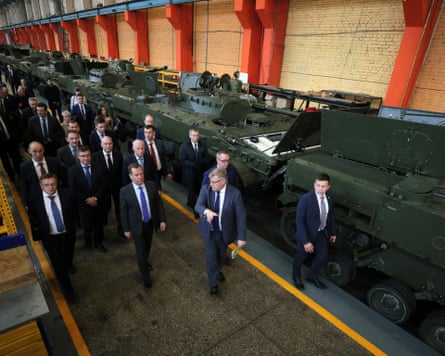

“For the first time since the invasion, the government is confronting a genuine trade-off: whether to build a tank or invest in the civilian economy,” said Maria Shagina, a Berlin-based senior fellow at the International Institute for Strategic Studies thinktank.

“For the Kremlin, the choice will always be military spending. But a widening deficit, soaring defence outlays and shrinking revenues are making that choice harder,” Shagina added.

By every metric, the economy is under strain. The finance ministry projects GDP growth in 2024–25 at less than 1%, compared with earlier forecasts of 2.3–2.5%.

German Gref, the powerful chief executive of the state-owned banking and financial services company Sberbank, conceded earlier this month that Russia had slipped into “technical stagnation”.

To bolster state coffers, Moscow announced this week it would increase VAT from 20% to 22%, reversing one of Putin’s earlier promises. Russians will now finance the war more directly, with defence spending – outstripping the combined defence budgets of Europe – accounting for about 40% of the Kremlin’s total outlay this year.

Putin, who for much of his rule prided himself on fiscal conservatism and economic stability, is facing a new reality.

Between January and July alone, the federal budget deficit hit 4.9tn rubles ($61bn), surpassing the full-year target; by 2026, the gap is forecast at about 4.6tn rubles ($55bn).

Two-thirds of the national welfare fund – touted as Russia’s rainy-day reserve – had been spent, said Shagina.

The picture is a sharp contrast to the first two years of the war, when massive state spending acted as a powerful stimulus, with the economy growing by 4-5% annually.

Factories producing weapons, uniforms and equipment ran at full tilt, resulting in record-low unemployment and lifting wages in provincial towns. For many Russians, the war economy translated into previously unimaginable higher salaries, even if inflation eroded some of the gains.

In his annual televised call-in last year, Putin told viewers: “The economy is developing, moving forward actively. Overall, the situation in Russia is stable, and growth continues despite all external threats and attempts to pressure us.”

But the wartime boom now appears to have run its course. “Russia can’t keep increasing military spending by 30% every year,” said the Russian economist Vladislav Inozemtsev. “Once the money stops flowing, the growth slows down too. It was never sustainable – that’s why the boom is over.”

The government is expected to cut spending across the board – from corporations to infrastructure, healthcare and housing – to plug the gap. Still, many in Ukraine believe western sanctions have failed to land the crippling blow Washington and Brussels had hoped for.

After the west weaned itself off Russian oil and gas, Moscow redirected its energy exports to India, China and Turkey, relying on a flotilla of “shadow fleet” tankers that proved difficult to bring under sanctions.

The Kremlin has also softened the impact of restrictions on critical goods by cultivating a thriving trade in parallel imports, exploiting what critics have called a “sanctions hole”.

Semiconductors, aircraft parts and consumer electronics such as iPhones are routinely funnelled into Russia through intermediaries in Turkey, the UAE and former Soviet states, including Armenia and Kazakhstan.

“If all sanctions had come in the first 60 days, Russia’s economy would have been destroyed,” said Inozemtsev. “Spread over four years, adaptation was inevitable,” he added.

In Brussels, there is little appetite to heed Trump’s call for Ukraine’s European allies to slap 100% tariffs on India and China, the biggest buyers of Russian oil, to end their trade with Moscow.

Meanwhile, Hungary and Slovakia have vowed to keep importing Russian energy.

Ukraine has sought to counter western hesitation with a huge wave of drone strikes on Russia’s oil infrastructure in recent months. Open-source data suggests that 16 of the country’s 38 refineries have been hit since August, sending diesel exports to their lowest levels since 2020 and causing widespread fuel shortages.

Initially confined to remote regions, reports of closed petrol stations have now emerged in the capital. More troubling for Moscow is that shortages are being reported in diesel, the fuel that underpins the Russian economy and its war machine.

“It will be truly crazy if, by the fourth year of the war, we still haven’t destroyed Ukraine’s energy sector, and they end up destroying ours,” one Russian pro-war blogger wrote this week.

Volodymyr Zelenskyy has hailed the drone strikes, calling them “the most effective sanctions, the ones that work the fastest”.

While long lines for fuel are a frustration for Russians, the central question is whether mounting economic pressures will be enough to compel Putin to alter his course in Ukraine.

Trump suggested in a Truth Social post that once Russians realised what was “really going on with this war” and with the Russian economy, some sort of popular revolt could follow. But observers caution against such expectations: Russians are accustomed to enduring hardship, and with dissent criminalised, they have few ways to express discontent.

“Russians can live with zero growth,” said Inozemtsev. “They lived through long periods of falling incomes without political cost to Putin. In the west, zero growth sparks panic. In Russia, it’s just normal.”

3 months ago

67

3 months ago

67