Just over two years ago, Wales gave councils the powers to massively increase council tax on second homes. If you were to read recent headlines, you would think this was a disaster.

“Fury,” said the Express. A “botched” policy that is “in tatters” after “£30k off house prices” lamented the Telegraph. Indeed, these publications are correct: the changes have led to something of an exodus of some second-home owners. What the titles seem to have missed, however, was that this was the point.

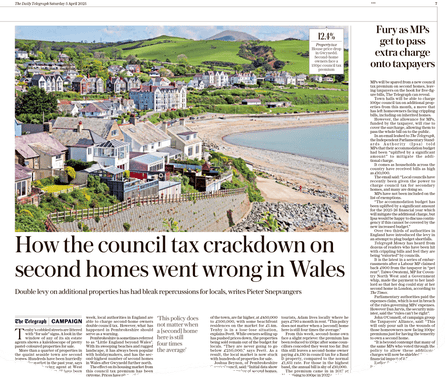

Due to the indisputable fact that our country is bloody fantastic, people love to visit and to buy second homes here. In some parts of Cymru, this has become a major problem. In the county of Gwynedd, the figures were astronomical. In 2021 of all the properties in Beddgelert, 23% were second homes. It was 25% in Aberdaron and up to 40% in Llanengan.

This has several knock-on effects. House prices soar, so local young people can’t get on the ladder where they grew up. Many of them are first-language Welsh speakers, which means the language is under threat in these rural areas that have safeguarded Cymraeg – the Welsh language – for centuries.

The high rates of second-home ownership also mean that, unless the weather is forecast to be good (which in Wales is about as often as an eclipse), these towns and villages are half empty. This causes pubs to close. There are fewer children, so schools close. It erodes the heart of our communities.

To try to tackle this, the Welsh Labour government, alongside Plaid Cymru, introduced measures to curb second-home ownership. This included giving councils the ability to push council tax on second homes to 300% the usual rate. They also closed a loophole whereby second-home owners could register as a business in order to pay the much lower business rates.

Gwynedd council used these powers to hike council tax to 150% in April 2023. By the end of 2024, house prices had fallen by 12.4% as second-home owners tried to sell up. In Pembrokeshire, house prices fell by 8.9% after the council increased the council tax to 200% on second homes (though this was reduced to 150% recently).

As is so often the case in the age of the culture war, some elements of the media lost their minds. The Mail reported an “anti-English attack”, and the fall in house prices was widely reported as a negative.

First things first: let’s put aside this “anti-English” rubbish. About two-thirds of those with holiday homes in Pembrokeshire live in Wales, predominantly South Wales. Being English isn’t the issue here. Second, just the summer before, the very same Daily Mail was reporting how tourists were “flocking in their droves to top locations in Bannau Brycheiniog National Park”, so it can’t be hitting tourism that hard.

Finally, it is hard to see the house-price drop as anything other than a positive. So often it feels like policy changes do little to directly help ordinary people and often do active harm (disability benefit changes, for example). What we have here is the pushing-through of a controversial policy because it will directly help communities negatively affected by the decisions of those who have more money.

Not that the policy is perfect. The closing of the business-rates loophole means that to register as a business, a property has to be let for 50% of the year (182 days). Therefore even if your property is let for every weekend and all of July and August, you won’t qualify as a business. This has punished many perfectly legitimate businesses, and even Plaid Cymru has admitted it will need to lower that if it is in power after 2026.

However, the impact of tourism isn’t just on second homes. It also causes problems for communities in terms of traffic, infrastructure and parking. To try to mitigate this, the Welsh government is introducing a tourist tax. This visitor levy is similar to the one you pay when you go to places like Barcelona on holiday.

Anyone who reads this column regularly knows that I am deeply disdainful of how Wales has been governed since devolution and feel the Welsh government has shown an almost crass lack of ambition for the country. But when it comes to the tourist tax, I think they’ve got it right.

The new law allows councils to charge a fixed fee of £1.25 per person per night for Airbnbs, hotels and self-catered lets and 75p per night for campsites (pitches) and stays in hostels. Children are exempt from being charged the visitor levy, meaning that if two parents took their kids away for a week it would add £17.50 to their stay.

This money is kept by local authorities and must be used to maintain and promote the Welsh language or the sustainable economic growth of tourism, or improve infrastructure, facilities and services used by visitors.

Frankly, an extra £1.25 to stay a night in Wales is the bargain of the century. In the same way that when you visit a free museum you chuck them a few quid in thanks, this is an investment in the place you are visiting.

It is thoughtful policymaking. The fee is refunded if you are a disabled person with a carer, a homeless person placed by the council or having to stay because of an emergency like a health issue or flooding. You also don’t have to pay if you are there for more than 31 days (they don’t want to punish hotel residents).

I am not for a moment saying that tourism is not a vital industry for Cymru – it absolutely is. I am also not saying that it doesn’t have its challenges, though data suggests that poor weather is easily our biggest one.

If you’ve spent some of the recent warm weather and bank holidays in Wales, I salute your impeccable taste. If you didn’t, you should know you are truly welcome. Please come to Wales. We are delighted to have you. But tip your host, and leave it how you found it.

-

Will Hayward is a Guardian columnist

6 hours ago

13

6 hours ago

13