Get started now

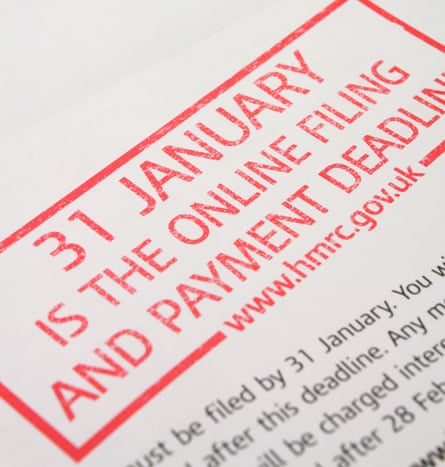

The deadline is 31 January, but don’t put it off – try to set aside enough time over the next few days to complete your tax return for the tax year that ran from 6 April 2024 to 5 April 2025.

If you leave it until the last minute and end up rushing to get it done, you are more likely to make a mistake or find you don’t have all the information you need. Also, the HM Revenue and Customs (HMRC) phone lines will be much busier in the final few days.

If you are unsure if you need to do one, there is an online tool on the HMRC website that you can use to check.

One of the first tasks is to find all the documents and information that you need, such as your P60, P45, P11D or PAYE coding notices and tax certificates for investments. That may mean logging into your company’s intranet or asking someone, so give yourself time in case this isn’t straightforward.

Use the HMRC app

You can use the tax department’s free and secure HMRC app to obtain and check a lot of the information, from your self-assessment “unique taxpayer reference” to details of your employment income.

You can also use it to set a reminder to make a self-assessment payment and ask HMRC’s digital assistant for help. It is likely to be a lot quicker than rummaging through paperwork or ringing up and waiting to speak to someone on the phone.

Remember side hustles

A second job that you do as an employee should already be taxed, but if you earn extra money through freelance work, casual jobs such as babysitting or dog walking, letting property, or trading of any kind you may need to pay HMRC.

Everyone has a trading allowance of £1,000 each tax year, which means you can earn up to that much on top of your main job without paying tax.

If you earned more than £1,000 in total from side hustles in 2024-25, you will need to register for self-assessment as a sole trader and do a return (and pay any tax due) by the end of January.

Remember your savings

When savings rates were really low, only those with very large sums in standard savings accounts were in danger of breaching the personal savings allowances of £1,000 for basic-rate taxpayers and £500 for higher-rate taxpayers. But because interest rates have increased, many people will have exceeded their allowance and be in a position where they have to declare income from savings.

There are lots of online calculators that will help you work out if you are one of them. If you are earning 4% interest on your savings, you can hold up to £25,000 before facing tax as a basic-rate payer, or £12,500 as a higher-rate payer.

Savings in tax-free accounts such as Isas and some NS&I products do not count towards your allowance.

Use pension tax relief

For many, the section of the form on pensions and tax is one of the most daunting. But if you are entitled to make a claim and don’t, you are losing out.

How it works depends on what type of scheme you are in. Net pay arrangements – used by many traditional workplace pension schemes – don’t require you to do anything to get tax relief. With these, your contributions are deducted from your pay by your employer before income tax is calculated, so you get relief immediately at your highest rate of tax.

But the rules are different if you are in a “relief at source” scheme – used by personal pension plans, plus some workplace schemes. If you are a 20% taxpayer, no further adjustment needs to be made, but higher-rate taxpayers usually have to make a claim via their tax return to receive the extra relief due to them.

To do this you need to enter the total you paid in during the year, plus the basic rate tax relief you received. If you have contributed £700, for example, the figure with basic rate tax relief added that you need to put on the form is £875 (£700 divided by 80 and multiplied by 100). HMRC will then work out the extra tax relief due to you on top of the basic rate claimed by your pension provider.

Be aware that there are slightly different rules for Scotland.

Remember child benefit

If you earn £60,000-plus and you or your partner claim child benefit, then this affects you (it doesn’t matter if the child living with you is not yours).

The high income child benefit charge is a way for the amount paid to higher earners to be clawed back via the tax system on a sliding scale. For the 2024 to 2025 tax year, the earnings threshold at which this kicks in is £60,000 a year.

It’s your “adjusted net income” that is important here. This is your total taxable income before any personal allowances, including things such as interest from savings and dividends from shares, minus things such as donations made to charity via gift aid and some pension contributions.

You can use HMRC’s child benefit tax calculator to get an estimate of your adjusted net income.

Don’t forget crypto gains

HMRC is cracking down on tax evasion involving “cryptoassets”, including digital currencies such as bitcoin and ethereum, and non-fungible tokens (NFTs).

New rules that took effect on 1 January will make it harder for crypto investors to hide their gains from UK and overseas tax authorities. And, for the first time this year, the self-assessment tax return has a dedicated section to declare any gains and losses (boxes 13.1 to 13.8 on the capital gains tax supplementary pages).

Include charity donations

Donating through gift aid means charities can claim an extra 25p for every £1 you give and if you are a higher-rate taxpayer you can also make a claim in your tax return.

Let’s say you donate £100 to a charity. It claims gift aid to make your donation £125. You pay 40% tax, so you can personally claim back £25 (£125 x 20%).

Remember to include any regular donations you make that are subject to gift aid, and to search emails and paperwork for one-off contributions that qualify.

Watch out for scams

HMRC is urging people to “stay alert to potential scams” before the deadline. It recently warned that more than 4,800 self-assessment scams had been reported since February 2025.

“If any emails, text messages or phone calls appear suspicious, don’t be lured into clicking on links or sharing your personal information – report it directly to HMRC,” says a spokesperson.

The department says it will never ask for personal or financial information via text or email; contact customers by email, text or phone to inform them about a refund or ask them to claim one; or leave voicemails threatening legal action or arrest. Anyone who receives suspicious communications can forward emails to [email protected], and text messages to 60599.

Check out these videos

If you need a bit of hand-holding, HMRC’s YouTube channel offers help with your tax return courtesy of short “how to” videos. They include one on viewing your self-assessment tax return calculation, and another on how you can use the HMRC app to make a self-assessment payment.

3 hours ago

4

3 hours ago

4