Trump: I'm recommending a 50% tariff on the EU

Newsflash: Donald Trump has just announced he is recommending a 50% tariff on goods from the Europen Union, from the start of next month.

Ratcheting up the trade war, Trump has claimed in a Truth Social post that the EU has been ‘very difficult’ to deal with, and that the current US trade in goods deficit is “totally unacceptable”.

Trump also claims that the EU was set up to take advantage of the US on trade.

He says:

The European Union, which was formed for the primary purpose of taking advantage of the United States on TRADE, has been very difficult to deal with.

Their powerful Trade Barriers, Vat Taxes, ridiculous Corporate Penalties, Non-Monetary Trade Barriers, Monetary Manipulations, unfair and unjustified lawsuits against Americans Companies, and more, have led to a Trade Deficit with the U.S. of more than $250,000,000 a year, a number which is totally unacceptable. Our discussions with them are going nowhere!

Therefore, I am recommending a straight 50% Tariff on the European Union, starting on June 1, 2025. There is no Tariff if the product is built or manufactured in the United States. Thank you for your attention to this matter!

Key events Show key events only Please turn on JavaScript to use this feature

The oil price has hit a two-week low after Donald Trump threatened hefty new tariffs on imports from the European Union.

Brent crude, the international benchmark, has fallen by 1.5% to as low as $63.32 per barrel. Traders will be calculating that a US-EU trade war will hurt the global economy, leading to lower demand for energy.

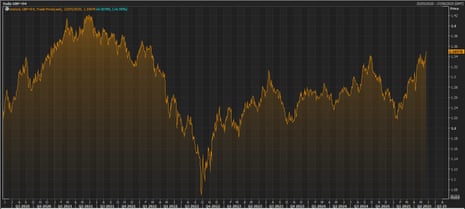

Trump’s tariffs threats have created a sea of red across European stock markets:

Analyst: Trump triggers new plunge in equities

Donald Trump’s two-pronged attack on the European Union, and on Apple, has swiftly destroyed hopes that the trade war was cooling.

There’s been a period of calm in the last couple of weeks, after the US and China agreed a 90-day pause and the elimination of most of the tariffs imposed on each other during April.

The threat of 25% tariffs on iPhones made abroad, and 50% on imports from the EU into America, has brought an end to the peace.

Fawad Razaqzada, market analyst at City Index and FOREX.com, says “all the optimism over trade deals [has been] wiped out in minutes – seconds, even”, explaining:

US index futures and Apple shares tumbled in premarket as Trump warned the company of 25% tariffs if manufacturing of iPhones is not moved to the United States.

He then triggered an even bigger after recommending 50% tariffs on EU starting June 1. The German DAX dropped over 500 points and similar moves were seen in US index futures

Markets fall after Trump threatens 50% tariff on EU imports

European stock markets are sliding after Donald Trump threatened the EU with a 50% tariff on its goods from the start of June (see previous post).

Germany’s DAX has fallen by 1.9% as investors digest Trump’s announcement, while Italy’s FTSE MIB has lost 2%.

The Stoxx 600 Banks Index, which tracks bank shares in Europe, is down 1.7%.

In London, the FTSE 100 index of blue chip shares has now dropped by 101 points, or 1.1%, as trade war fears sweep the City again. Bank stocks are among the big fallers.

Trump: I'm recommending a 50% tariff on the EU

Newsflash: Donald Trump has just announced he is recommending a 50% tariff on goods from the Europen Union, from the start of next month.

Ratcheting up the trade war, Trump has claimed in a Truth Social post that the EU has been ‘very difficult’ to deal with, and that the current US trade in goods deficit is “totally unacceptable”.

Trump also claims that the EU was set up to take advantage of the US on trade.

He says:

The European Union, which was formed for the primary purpose of taking advantage of the United States on TRADE, has been very difficult to deal with.

Their powerful Trade Barriers, Vat Taxes, ridiculous Corporate Penalties, Non-Monetary Trade Barriers, Monetary Manipulations, unfair and unjustified lawsuits against Americans Companies, and more, have led to a Trade Deficit with the U.S. of more than $250,000,000 a year, a number which is totally unacceptable. Our discussions with them are going nowhere!

Therefore, I am recommending a straight 50% Tariff on the European Union, starting on June 1, 2025. There is no Tariff if the product is built or manufactured in the United States. Thank you for your attention to this matter!

Apple shares drop in pre-market

Apple shares are falling in pre-market trading after Donald Trump threatened the company with new tariffs unless it shifts iPhone production to the US.

They’re currently on track to fall by around 3% when trading begins on Wall Street, in under two hour’s time.

BREAKING: Apple stock, $AAPL, falls -4% as President Trump says iPhones must be built in the US or they will face a tariff of at least 25%. pic.twitter.com/anyxsdNxjx

— The Kobeissi Letter (@KobeissiLetter) May 23, 2025Trump threatens Apple with 25% tariffs if iPhones not made in US

Newsflash: Donald Trump has fired another shot at Apple in his trade wars, warning that the tech giant must pay a 25% tariff unless it manufactures its iPhones in the US.

Posting on his Truth Social website, Trump says:

“I have long ago informed Tim Cook of Apple that I expect their iPhone’s that will be sold in the United States of America will be manufactured and built in the United States, not India, or anyplace else.

“If that is not the case, a Tariff of at least 25% must be paid by Apple to the U.S. Thank your for your attention to this matter!”

This is the US president’s latest attempt to force Apple to move manufacturing to the US; last week, Trump said he had a “little problem” with Apple’s Tim Cook, after reports that the company is planning to switch assembly of handsets for the US market from China to India.

Sky News: Two-way race to buy Poundland

The battle to take control of UK discount chain Poundland has taken a twist.

Sky News are reporting that Poundland’s owner, Pepco Group, has shortlisted two rival firms to buy Poundland, which needs a capital injection of more than £50m to aid a turnaround plan.

A Pepco insider said on Friday that Hilco, the former owner of HMV and Homebase, and former Laura Ashley-owner Gordon Brothers were involved in a two-way race to buy the chain.

That means that Modella Capital, the investment firm which has agreed to buy WH Smith’s high street operations, has been eliminated from the auction.

Yesterday, Pepco cut its profit guidance for Poundland, due to “highly challenging trading conditions, which have been further impacted by clearance of old stock and product availability issues”.

UK private sector productivity drops below pre-Covid levels

Worryingly, productivity in the UK private sector has dropped below its levels before the Covid-19 pandemic.

New data from the Office for National Statistics this morning shows that multi-factor productivity – a measure of how efficiently resources are used in the economy – fell by 0.6% in 2024 and was 0.7% lower than in 2019.

That, the ONS points out, is rather worse than the trend growth in MFP of around 1.8% per year in the decade before the 2008 economic downturn.

The report shows that market sector gross value added (GVA) only increased by 1.3% in 2024, while hours worked rose by 1.8%.

Pound hits $1.35

Back in the financial markets, the pound has hit $1.35 against the US dollar for the first time since February 2022.

As flagged at 9.52am, the pound is benefiting from some optimism about the UK economic outlook, and worries about inflation, while the dollar is being dragged down by concerns that investors are losing faith in US government debt.

PwC: Energy price cap could rise later in the year

The UK energy price cap could rise again later this year, warns Benjamin Gough, Infrastructure & Regulatory Economics Leader at PwC UK.

Gough says:

“Today’s announcement by Ofgem of a reduction in the energy price cap is good news for domestic consumers, who will see an annual reduction in energy spend of £129 compared to the existing cap.

The decision follows a decline in UK natural gas futures, from a two-year peak of 141 p/th in February, with the downward trend driven in part by the UK experiencing a warmer start to spring and increasing volumes of LNG supply in Europe. Gas futures do remain higher than 2024 currently, leaving a possibility that the cap could still rise later in the year.

That would clearly be bad news for poorer households, especially as energy usage rises in the winter as the cold weather bites.

Cornwall Insight have predicted that the cap could rise to £1,727 per year, for a typical bill, in October-December, so only slightly higher than the £1,720/year set for July-September this morning.

[reminder: the cap applies to the cost of a unit of energy, not the total bill].

Independent Age, a charity providing support for older people facing financial hardship, has warned that too many people in later life living in financial hardship won’t be able to heat their homes, despite the drop in the price cap in July.

Independent Age chief executive Joanna Elson, CBE welcomed Keir Starmer’s u-turn on winter fuel payments, saying:

“The UK Government must use the warmer months to prepare for next winter. Older people on low incomes should be supported so that they have enough money to turn the heating on. We welcome plans announced this week to widen the eligibility criteria for the Winter Fuel Payment, linking it to Pension Credit saw far too many people in financial hardship miss out.

We heard dreadful accounts of people going to bed in hats and coats, limiting themselves to just one meal a day to save money, and having to visit public places to stay warm. We urge the UK Government to act quickly and provide clarity on who will be eligible for the next payment. Nobody should be left in the cold next winter.

In the long-term, the UK Government must implement policies that lift older people out of fuel poverty and ensure financial security. The UK Government should extend the Warm Home Discount beyond 2026, increase payments above the present £150 level, and introduce an energy social tariff.

Here’s a chart showing how UK energy bills will dip this summer, but remain rather higher than three years ago…

Pound hits three-year high vs US dollar

The pound has hit a new three-year high against the US dollar this morning.

Sterling is up around three-quarters of a cent to $1.3488, its highest level since February 2022.

The rally partly reflects relief that UK retail sales volumes jumped by 1.2% in April (see previous post), suggesting consumers are continuing to spend.

George Vessey, lead FX and macro strategist at Convera, says there are several positive factors supporting sterling.

Vessey cites:

Closer trade relations with both the US and EU, a string of positive UK economic data surprises and sticky inflation prompting a less dovish Bank of England (BoE) outlook and the de-dollarisation narrative.

The options market has turned more and more optimistic on the pound’s long-term outlook and hedge funds remain bullish, steadily increasing their long positions since January. This rising demand for sterling suggests further upside potential, especially if asset managers shift to overweight positions in the coming months.

The other side of the trade is that the dollar is falling, amid concerns that investors are shifting away from Us assets due to concerns over Donald Trump’s policies.

That has led to a sell-off in Treasury bonds this week, pushing up the interest rate on US debt.

Those worries mounted this week after the US House of Representatives approved a major bill that would enact Donald Trump’s tax and spending priorities and add trillions of dollars to the US debt (already $36trn and rising).

Sun brings biggest jump in British retail sales in four years

Mark Sweney

Sunny spring weather sent shoppers flocking to supermarkets and specialists such as butchers, bakers and alcohol outlets last month, fuelling the strongest quarterly increase in retail sales in Great Britain in almost four years.

Retail sales volumes soared 1.2% in April, well ahead of City economists’ forecasts of an increase of between 0.2% and 0.4%, marking the fourth straight month of sales growth.

The Office for National Statistics (ONS) said that over the three months to the end of April sales rose by 1.8%, compared with the November to January period, the largest quarterly rise since July 2021.

Martin Lewis: The Price Cap is still a Pants Cap

Martin Lewis, founder of MoneySavingExpert.com, has warned that the 7% cut in Britain’s energy price cap is “nothing to shout home about”.

Lewis, a regular critic of the price cap, points out that energy bills this July will still be 10% higher than at the same time last year.

He adds:

Compare that to the cheapest fixes on the market today, which are 18% below the current Cap, proving the Price Cap is a Pants Cap. It was only ever meant to be a back-stop tariff for those unable to switch, yet during the energy crisis it effectively became a regulated price, and still today, 65% of homes are on tariffs dictated by the Cap.

For all but those on pre-payment meters, where sadly there’s little choice, I’d urge people to get off the Cap, use a whole-of-market comparison site, like www.CheapEnergyClub.com to find their cheapest fix. That will instantly cut people’s bills, without any need to wait until July, and if analysts’ current Price Cap predictions prove true, would substantially undercut the Cap in every period for the next year.

Our recent analysis shows, that at every point over the last twelve months, grabbing the cheapest fix on the market would’ve saved you very substantially over the Price Cap.

Lewis also argues it’s incorrect for Ofgem to say that today’s reduction is a drop of £129 a year. He explains:

That’s not correct. The new Price Cap only lasts three months, so quoting an annualised price is meaningless, never mind an annualised price based on typical use.

Miliband welcomes cut to energy price cap

Back in the energy world, Ed Miliband has welcomed the 7% cut to household bills from July announced this morning.

However, the energy secretary also stressed that the Government will continue to work towards clean energy to get off the “rollercoaster of fossil fuel markets”.

Miliband says:

“This fall in energy bills is welcome news for families across the country and will mean that working people keep more of their money in the coming months.

However, we know that it is only through our mission for clean, homegrown power that we can get off the rollercoaster of fossil fuel markets controlled by dictators and petrostates - and give families and businesses energy security and bring down bills for good.

As we take back control, we are doing everything we can to support people - from consulting on expanding the £150 warm home discount to around six million households next winter, to upgrading thousands of homes so they are warmer and cost less to heat, to reforming our energy market so consumers are better protected.”

Telegraph to be sold to RedBird Capital in £500m deal

The future of the Telegraph newspaper appears to finally have been resolved.

The Telegraph is to be sold to a transatlantic consortium led by RedBird Capital Partners, the paper is reporting this morning, under a preliminary deal.

Gerry Cardinale, the founder of the US private equity firm, has reportedly signed an agreement in principle to acquire control of The Telegraph for £500m.

The Telegraph is being bought from RedBird IMI, an investment vehicle majority backed by the United Arab Emirates, who were blocked from taking full ownership of the group last year.

But this may not be the end of the story, as the Telegraph’s Chris Williams reports:

No final agreements are in place, however.

A rival is attempting to disrupt the sale too, and regulatory hurdles await.

Williams adds that Cardinale plans to target “an intelligent centre-Right readership which is not currently well-served”….

International Paper to close 5 sites in UK, putting 300 jobs at risk

Hundreds of packaging jobs are at risk at UK packaging firm DS Smith, following its takeover by rival International Paper earlier this year.

International Paper has announced this morning it is proposing to close five of its packaging sites in the UK. It is also considering relocating one site, and a “small headcount reduction” at two other sites.

International Paper says the plan will “improve efficiencies” and to respond to customer needs amid “tough trading conditions for the industry”. It is consulting with unions and workers.

International Paper, which took over DS Smith in a £5.8bn deal in January, expects the proposals would be implemented by the end of this calendar year and that approximately 300 roles may be affected.

3 months ago

164

3 months ago

164