UK housebuilding in deepest slump since 2020

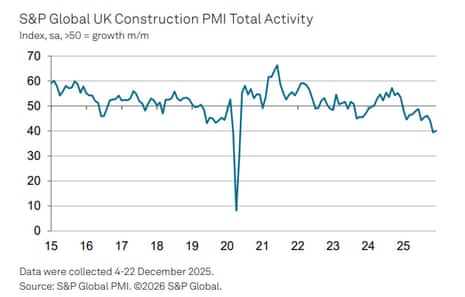

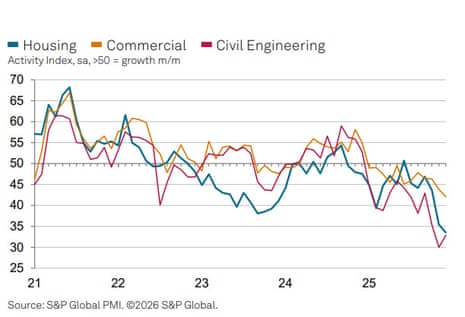

Newsflash: Britain’s construction sector continued to shrink in December, as housing, commercial and civil engineering activity suffered sharp falls again.

Data provider S&P Global has reported that activity across the UK construction sector, and new orders, both fell again last month.

Housebuilding and commercial construction work both decreased at the fastest rate since May 2020, when the Covid-19 lockdown forced building sites to close, S&P Global’s survey of purchasing managers at UK construction firms shows.

That highlights the government’s struggle to hit its housebuilding targets.

Civil engineering was the weakest-performing category of construction activity in December; it also shrank, but not by as much as in November.

This lifted the UK’s construction PMI index slightly to 40.1 in December, up from 39.4 in November, but still showing a contraction – for the 12th month runnng (50 = stagnation).

The drop extended the sector’s downturn to 12 months, its longest unbroken run of contractions since the global financial crisis of 2007-09, Reuters reports.

S&P Global says there is anecdotal evidence that fragile confidence among clients had hit workloads, and that delayed investment decisions ahead of the Budget in November had hurt sales.

More happily, though, business activity expectations for the year ahead rebounded to a five-month high, which suggests that budget uncertainty has lifted.

Tim Moore, economics director at S&P Global Market Intelligence, says:

“UK construction companies once again reported challenging business conditions and falling workloads in December, but the speed of the downturn moderated from the five-and-a-half-year record seen in November. Many firms cited subdued demand and fragile client confidence. Despite a lifting of Budget-related uncertainty, delayed spending decisions were still cited as contributing to weak sales pipelines at the close of the year.

By sector, latest data indicated the fastest reductions in housing and commercial construction since May 2020, while civil engineering was the only segment to signal a slower pace of decline than in the previous month.

Key events Show key events only Please turn on JavaScript to use this feature

Construction PMI: what the experts say

Despite December’s stumble, there are hopes that the UK construction sector could revive in 2026.

Brian Smith, head of cost management at consultancy AECOM, says:

“This week’s icy conditions somewhat reflect the mood of the construction industry and could prevent a fast start to the year. But, as today’s figures show, things are starting to improve for contractors and January will all be about positioning themselves to gradually expand capacity and be on the front foot to win new work when it comes.

“Everything points towards a further slowdown in inflation and cuts in interest rates to match this year, which will embolden clients and developers to kickstart schemes left on the back burner. However, if everything starts at once, it’s essential that the planning system is equipped to manage the uptick in projects – embracing AI and digital tools to complement the influx of new planners will prove crucial.”

Max Jones, Director & Head of Construction at Lloyds, also sees reasons for optimism:

“Despite today’s figures, there are some encouraging signs as we head into 2026, including investment in major infrastructure projects which could help accelerate activity, offering a more optimistic outlook for the industry.

“Recent supply chain improvements mean firms are well placed to meet increased demand, although the sector could face renewed pressure on labour availability. While project pipelines expand, competition for specialist skills may intensify and firms that can plan for this now will be best positioned to seize opportunities for the months ahead.”

Britain’s short-term government borrowing costs have fallen, as the City reacts to the downturn in UK construction.

UK two-year gilt yields have fallen to their lowest level since August 2024 – they’re down 4 basis points to 3.661%.

That’s a sign that investors are anticipating cuts to UK interest rates.

Currently the money markets are pricing in one cut by June, and possibly a second by the end of 2026.

But earlier this week Goldman Sachs predicted there will be three quarter-point rate cuts by next Christmas, which would bring Bank Rate down to 3%.

But some

This chart shows how activity in UK housebuilding, and commercial construction, both fell to their lowest in over five years in December:

UK housebuilding in deepest slump since 2020

Newsflash: Britain’s construction sector continued to shrink in December, as housing, commercial and civil engineering activity suffered sharp falls again.

Data provider S&P Global has reported that activity across the UK construction sector, and new orders, both fell again last month.

Housebuilding and commercial construction work both decreased at the fastest rate since May 2020, when the Covid-19 lockdown forced building sites to close, S&P Global’s survey of purchasing managers at UK construction firms shows.

That highlights the government’s struggle to hit its housebuilding targets.

Civil engineering was the weakest-performing category of construction activity in December; it also shrank, but not by as much as in November.

This lifted the UK’s construction PMI index slightly to 40.1 in December, up from 39.4 in November, but still showing a contraction – for the 12th month runnng (50 = stagnation).

The drop extended the sector’s downturn to 12 months, its longest unbroken run of contractions since the global financial crisis of 2007-09, Reuters reports.

S&P Global says there is anecdotal evidence that fragile confidence among clients had hit workloads, and that delayed investment decisions ahead of the Budget in November had hurt sales.

More happily, though, business activity expectations for the year ahead rebounded to a five-month high, which suggests that budget uncertainty has lifted.

Tim Moore, economics director at S&P Global Market Intelligence, says:

“UK construction companies once again reported challenging business conditions and falling workloads in December, but the speed of the downturn moderated from the five-and-a-half-year record seen in November. Many firms cited subdued demand and fragile client confidence. Despite a lifting of Budget-related uncertainty, delayed spending decisions were still cited as contributing to weak sales pipelines at the close of the year.

By sector, latest data indicated the fastest reductions in housing and commercial construction since May 2020, while civil engineering was the only segment to signal a slower pace of decline than in the previous month.

Britain’s blue-chip share index is continuing to slide this morning; the FTSE 100 is now down almost 50 points, or 0.5%, at 10,074.

Precious metals producer Fresnillo (-4.1%) are the top faller, followed by copper producer Antofagasta (-4%), following drops in the price of gold, silver and copper this morning.

Precious metals prices are also dropping this morning, after strong gains in recent sessions.

Silver dropped by over 3% to $78.60 an ounce in early trading, while gold is down 0.75% at $4,460/oz and platinum has lost more than 5%.

Global stock market rally stumbles as geopolitical tensions rise

The stock market rally that had pushed up shares at the end of 2025 and the start of this year is faltering today.

European markets are mixed this morning, after losses in Asia-Pacific markets overnight, as investors fret about rising geopolitical tensions.

There’s plenty to contemplate. Firstly, the White House stated overnight that using US military to acquire Greenland is ‘always an option’, as European leaders try to deter Trump from moving on the island.

Secondly, China’s Ministry of Commerce has announced a ban on exports of all dual-use items-goods with civilian and military applications- to the Japanese military, after Japan’s PM Sanae Takaichi suggested last year that a Chinese invasion of Taiwan could trigger a military response from Tokyo.

Japan’s Nikkei 225 index has fallen 1% today, while China’s markets are flat – as is the pan-European Stoxx 600.

Kathleen Brooks, research director at XTB, says:

The global stock market rally that has taken financial markets by storm in recent days has lost momentum as we move through the week. Asian stocks fell by more than 1%, commodities are also lower, with gold, oil and siler all falling.

There are a few themes that are driving price action today, firstly Japan and China tensions weighed on shares in the two countries as China announced new export controls on Japan, after comments from Tokyo about Taiwan, which angered Beijing. This fallout caused the Nikkei to fall more than 1% and the Hang Seng was also lower by a similar amount.

This fallout comes after Asian stocks had their best start to the year ever, so a pullback after four days of strong gains was to be expected, and geopolitics may have been a convenient excuse to book some profits.

Donald Trump’s ambition to supercharge Venezuela’s oil production would damage the climate, and undermine efforts to limit dangerous global heating, experts have warned.

Even raising production to 1.5m barrels of oil a day from current levels of around 1m barrels would produce around 550m tons of carbon dioxide a year when the fuel is burned, according to Paasha Mahdavi, an associate professor of political science at the University of California, Santa Barbara. This is more carbon pollution than what is emitted annually by major economies such as the UK and Brazil.

“If there are millions of barrels a day of new oil, that will add quite a lot of carbon dioxide to the atmosphere and the people of Earth can’t afford that,” says John Sterman, an expert in climate and economics at the Massachusetts Institute of Technology.

Unicredit on Trump’s 'gunboat diplomacy'

Donald Trump’s “gunboat diplomacy” in Venezuela shows that securing access to critical natural resources such as oil is now a key priority for Washington, say analysts at Unicredit.

They point out, in a note to clients, that the toppling of Venezuelan President Nicolás Maduro marked a decisive break with the rules‑based international order, ushering in a more assertive, America‑First form of hegemony across the western hemisphere.

It also intensifies the US’s strategic rivalry with China, Unicredit point out:

Given that China was the main buyer of smuggled Venezuelan oil and is Caracas’s principal creditor, the move is clearly intended to send a strong signal to Beijing, which has ambitious plans in South America, particularly in resource‑rich countries such as Peru.

In 2023, China and Venezuela formalised an “all‑weather strategic partnership”. Beijing also used oil trade with Caracas to expand the international footprint of the CNY [the yuan], thereby weakening the effectiveness of US sanctions. Maduro’s removal thus serves as a warning to other authoritarian leaders to exercise caution when deepening diplomatic and economic ties with China at the expense of the US.

Shares in energy companies are dropping at the strat of trading in London.

BP (-2.7%) are the top faller on the FTSE 100, with Shell dropping by 1.8%.

That’s pulling the blue-chip FTSE 100 shares index into the red too; it’s down 28 points or 0.27% at 10,095, having hit a record high yesterday.

The value of the Venezuelan oil being claimed by Donald Trump could be as much as $2.8bn – if there is as much as 50 million barrels, at the current US crude price of $56 a barrel.

Trump’s move on Venezuela’s oil is attracting criticism.

“This is confiscatory, imperialistic and there is no justification for it,” said Jeffrey Sonnenfeld, a professor at Yale’s business school, the Financial Times reports.

Sonnenfeld added:

“There is also no need for this oil as we have a global oil glut.”

One theory is that unless the oil is moved, Venezuela’s production could shut down as the country is running out of space to stash crude due to the US blockage.

Introduction: Oil falls after Trump says Venezuela will send supply to US

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The aftermath of the US intervention in Venezuela is continuing to send ripples through the markets.

The oil price is dropping today, after Donald Trump declared that Venezuela will send the US between 30 million to 50 million barrels of oil, which will then be sold… with the president controlling the proceeds, which could be more than $2bn.

Posting on his Truth Social site, Trump declared:

“This Oil will be sold at its Market Price, and that money will be controlled by me, as President of the United States of America, to ensure it is used to benefit the people of Venezuela and the United States!”

There are currently millions of barrels of Venezuelan oil stashed on tankers and in storage tanks due to the US blockage imposed by Trump. The news that this oil could soon follow president Nicolás Maduro in an unexpected journey to the US had an immediate impact on the oil market.

US crude has dropped by 1.6% to $56.21 a barrel, as traders anticipate more supply hitting the market, adding to Tuesday’s losses.

Brent crude, the international benchmark, has dropped by 1.2% – back below $60 a barrel at $59.97.

The move also has geopolitical implications; two sources have told Reuters that supplying the trapped crude to the US could initially require reallocating cargoes originally bound for China.

Jim Reid, market strategist at Deutsche Bank reports that headlines suggesting that the US was keen to avoid disruption to Venezuela’s oil exports pushed oil down yesterday, telling clients:

Reuters reported that Venezuela was in talks to export oil to the US while Bloomberg reported that Chevron had booked extra tankers to Venezuelan ports this month, so potentially mitigating the decline in oil shipments from the country amid the recent US naval blockade.

Indeed, Brent is trading another -1.65% lower this morning after Trump said last night that Venezuela would turn over “between 30 and 50 MILLION barrels” of oil to the US. There wasn’t much extra detail but this sort of volume is around 30-50 days of pre-US blockade production so this could be the oil that has been sitting around and probably doesn’t mark the start of a trend.

There’s a lot for energy companies to process at the moment; earlier this week Trump suggested US taxpayers could reimburse energy companies for repairing Venezuelan infrastructure for extracting and shipping the country’s heavy oil.

The agenda

-

9.30am GMT: UK construction PMI for December

-

10am GMT: Eurozone December inflation flash reading

-

3pm GMT: US JOLTS job openings stats for November

1 day ago

15

1 day ago

15