UK inflation held steady in August, official figures show, maintaining pressure on households as the Bank of England prepares to keep borrowing costs at elevated levels.

Figures from the Office for National Statistics (ONS) show the annual rate of inflation as measured by the consumer price index remained at 3.8% last month, the same level as July and matching the forecasts of City economists.

Financial markets are widely predicting Bank policymakers will keep interest rates on hold at 4% on Thursday amid signs of sustained inflationary pressures at almost twice its official 2% target rate.

After sharp increases in the headline rate in recent months, the ONS said various price movements offset each other in August. The cost of air fares was the main downward driver, while prices rose for petrol and diesel. The cost of hotel accommodation also fell by less than this time last year.

Food price inflation climbed for a fifth consecutive month, up from 4.9% in July to 5.1% in August, with small increases in a range of vegetables, cheese and fish items. The price of sweets and chocolates rose by 10.5%, while the cost of beef, butter and coffee also increased sharply.

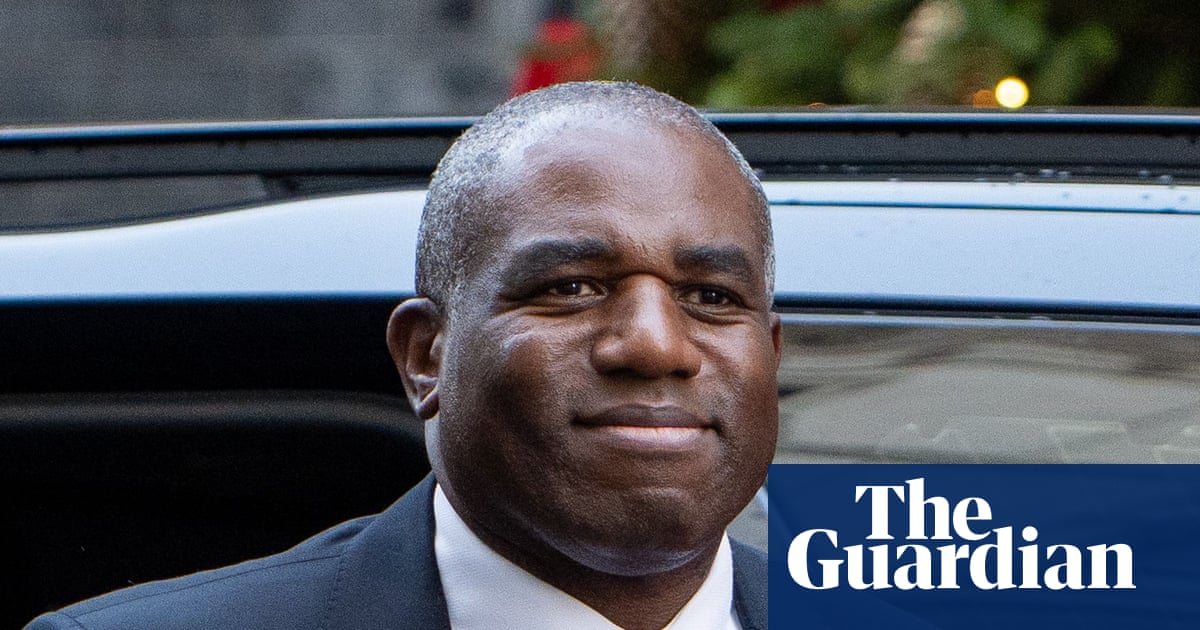

The chancellor, Rachel Reeves, is facing intense scrutiny over Labour’s economic management amid widespread speculation about tax increases in her autumn budget, which is expected on 26 November.

Business groups said that the chancellor’s first autumn budget measures, including the £25bn increase in employer national insurance contributions, would force them to cut jobs and raise prices.

Mel Stride, the shadow chancellor, said: “With borrowing costs hitting a 27-year high, working people and businesses are bracing for even more tax rises to pay for Labour’s mismanagement.”

Reeves said the government was taking action to help households. “I know families are finding it tough and that for many the economy feels stuck. That’s why I’m determined to bring costs down and support people who are facing higher bills.”

The Bank forecasts inflation is on track to peak at 4%, with the potential to delay further interest rate cuts. Threadneedle Street has cut borrowing costs five times since summer 2024.

City economists said there were some signs that inflationary pressures were beginning to abate. Inflation for consumer services, which is closely watched by the Bank, slowed to 4.7% from 5% in July. Core inflation, which excludes energy, food and tobacco prices, fell to 3.6% from 3.8%.

after newsletter promotion

Official figures on Tuesday showed the jobs market cooled in July, while economic growth remains weak; adding to pressure on the Bank to consider a cut in rates. The ONS will provide updated figures for retail sales and the government finances on Friday. However, analysts said concerns remained over stubborn inflation.

Martin Sartorius, the principal economist at the CBI business lobby group, said: “The monetary policy committee [MPC] looks set to keep interest rates unchanged tomorrow and, going forward, the MPC faces a delicate balance between signs of a cooling labour market and the risk of price pressures remaining stubbornly high.”

UK inflation is higher than in the US, where it increased to 2.9% in August, and in the eurozone where it rose to 2.1%, just above the European Central Bank’s 2% target.

3 months ago

115

3 months ago

115