UK economy grew by 0.3% in November

Newsflash: The UK economy has returned to growth, and more vigorously than expected.

UK GDP expanded by 0.3% in November, new data from the Office for National Statistics shows, after shrinking a little in October.

That’s faster than expected; City economists had expected growth of just 0.1%

In another boost, September’s growth figures have been revised higher, showing that the economy didn’t shrink that month after all.

The ONS says:

Monthly GDP is estimated to have grown by 0.3%, following an unrevised fall of 0.1% in October 2025 and a growth of 0.1% in September 2025 (revised up from our initial estimate of a fall of 0.1%).

More to follow….

Key events Show key events only Please turn on JavaScript to use this feature

South East Water boss in line for £400,000 bonus despite outages

Jasper Jolly

In news that may enrage the waterless residents of Kent and Sussex, the boss of South East Water is in line for a £400,000 long-term bonus regardless of his performance, if he resists calls for him to resign over the outages.

David Hinton, the chief executive of South East Water, is to receive the payout if he stays on until July 2030.

Hinton is facing calls to give up his right to the previously unreported “service award”. The payment, which was disclosed in the company’s annual report, is not performance-related, meaning that as long as he remains, Hinton will receive it whatever the company’s record on water supplies or pollution.

Over in the US, the number of Americans filing new claims for unemployment benefits have dropped.

Last week, there were 198,000 initial claims, a decrease of 9,000 from the previous week.

That suggests US companies continued to hold onto workers, despite recent signs that the labor market was cooling.

The National Institute of Economic and Social Research (NIESR) have predicted that the UK economy got off to a good start in 2026.

They say that early estimates point to 0.3% growth in the first quarter of the year, following this morning’s GDP report for November.

Yesterday’s UK offshore windfarm auction will support up to 7,000 jobs across the country, the government has annouced.

The Department for Energy Security and Net Zero has calculated that the successful renewables auction will bring £3.4bn of private sector investment into the UK, to support factories, ports and domestic supply chains

DESNZ says:

Every £1 of public money invested through the government’s new Clean Industry Bonus leverages £17 from industry in an unprecedented vote of confidence in UK’s industrial strategy and clean energy mission.

Investment means factories, ports and supply chains built in Britain, supporting up to 7,000 jobs in the country’s industrial heartlands and most deprived regions, as part of 400,000 new clean energy jobs by 2030.

As we reported yesterday, subsidy contracts for enough offshore windfarms to power 12m homes were awarded through the auction for renewable subsidies, after ministers doubled the amount of funding available to developers to help them produce projects.

Goldman Sachs posts jump in profits and revenues

Over on Wall Street, Goldman Sachs has reported a jump in revenues and profits.

Goldman grew its revenues by 9% during 2025, to $58.28bn, lifted by higher activity at its global banking and markets division.

Earnings per share swelled too – to $51.32 for the year ended December 31, 2025, up from $40.54 a year earlier.

David Solomon, chairman and ceo of Goldman Sachs, says:

We continue to see high levels of client engagement across our franchise and expect momentum to accelerate in 2026, activating a flywheel of activity across our entire firm. While there are meaningful opportunities to deploy capital across our franchise and to return capital to shareholders, our unwavering focus remains on maintaining a disciplined risk management framework and robust standards.”

Green Party's Zack Polanski calls on PM to bring South East Water into public hands

Green Party leader Zack Polanski is calling on Sir Keir Starmer to take South East Water into public ownership through the special administration regime, following the company’s failure to provide water to customers in Kent and Sussex since November.

In a letter to the prime minister, Polanski says South East Water has “clearly failed” to make the necessary investments in infrastructure in order to continue meeting its duty to customers, spending less on repairs than it handed to shareholders and bond holders.

Polanski insists that the threshold for special administration has been cleared, writing:

There is a clear alternative: bringing water back into public hands by placing failing water companies into special administration. In special administration, the government can refuse to pay shareholders compensation. Crucially, it can also refuse to pay debtholders if this would interfere with water company performance.

In the case of South East water the government would be entitled to say that the repair costs exceed the debt, so the debt need not be repaid (that the ‘appropriate value’ for debtholders to get is zero).

In September 2025, Minister Emma Hardy set an exceptionally high bar for special administration, telling the Defra select committee they would only put a water company into special administration if ‘fundamentally water does not come out of the tap and your toilet does not flush and sewage does not go away.’

Even this extremely high threshold set by the government, far beyond what the law requires in order to put a water company into special administration, has been met. Water this week did not come out of the taps in 25,000 homes around the south of England.

FTSE 100 at new record high

Britain’s stock market has hit a new record high this morning, as City traders welcome the UK’s forecast-beating growth in November.

The FTSE 100 has hit a new alltime high of 10,235 points this morning, adding to its gains since it broke through the 10,000-point mark at the start of this year.

Asset management firm Schroders (+6.8%) after lifting their profit guidance this morning.

Joshua Mahony, chief market analyst at Scope Markets, says:

The FTSE 100 once again remains a leader in Europe, although the pullback in oil and precious metals has meant that commodity stocks are lagging behind as financials take the lead. Strong gains for the likes of HSBC, Barclays, and NatWest bring a recovery from a sector that has been hit by Trump’s recent move to limit credit card interest rates to 10%.

However, today has seen a positive update out of the UK, with GDP posting a surprise monthly gain of 0.3% for the month of November. This comes after an October contraction, which had been heavily impacted by a 27% slump in car production following a cyber-attack on Jaguar Land Rover. The snapback in manufacturing highlights how volatile monthly data can be, and why not every piece of data should be seen solely through a political prism.

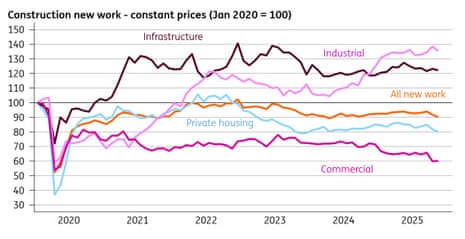

That being said, the underlying picture remains soft in the UK. Construction continues to deteriorate, with output falling again in November and now almost 3% lower since July.

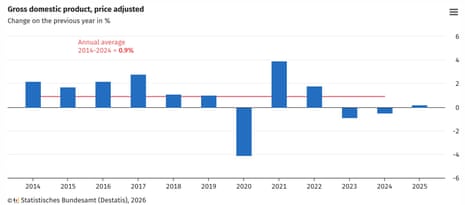

There’s also celebration in Germany today after the country’s economy returned to growth.

Germany’s Federal Statistics Office has reported that German GDP grew by 0.2% in the final quarter of last year and also increased by 0.2% over the full-year 2025.

That’s the first annual growth since 2022, following contractions in the last two years.

Ruth Brand, President of the Federal Statistical Office, told reporters:

“After two years of recession, the German economy edged back into growth. The growth is primarily attributable to increased household consumption and government expenditure.”

Household consumption and government spending both added to growth last year, but investment fell.

This is “finally, some positive news” for the German economy, says Carsten Brzeski, global head of macro at ING.

Brzeski explains:

New Year’s traditions vary – ice diving, eating special cakes, or reflecting on the past year’s economic performance. For us, the most relevant is the German statistical office’s tradition of opening the year with a press conference and an assessment of the past economic year. This morning’s press conference delivered mildly positive news on Germany’s economy.

According to the first estimates, the German economy grew by 0.2% year-on-year in 2025, after two years of recession. Private and public consumption were growth drivers, while investments and exports were a drag on the economy. This first estimate is – as always – based on a very tentative estimate for the final quarter of the year. According to the statistical office, the economy grew by 0.2% quarter-on-quarter in the fourth quarter of 2025.

We Own It: Revoke South East Water's licence now

Cat Hobbs, director of the We Own It campaign, which advocates the public ownership of essential services, hopes South East Water will be taken out of private hands, to fix the problems at the company.

Hobbs explains:

“South East Water must absolutely have its licence withdrawn immediately. The government must bring it into special administration and then permanent public ownership. Anything else - fines, resignations - is tinkering around the edges.

Privatisation and regulation have been failing now since 1989, they will never work. South East Water spent more on dividends for private shareholders than on infrastructure. That’s why people don’t have access to water right now, the most basic service, and that’s why we need public ownership.

Water is a natural monopoly so we have no choice about our supplier and every penny of investment comes from customers. It’s time to end the rip off. 9 out of 10 countries run water in public ownership. England needs to stop the failed ideological experiment of privatisation and do the same.

Households and anti sewage groups should be on the board of publicly owned South East Water so it can be accountable to them, instead of to a handful of shareholders in Australia and Canada.”

River Action: Ofwat investigation into South East Water is long overdue

News that Ofwat is investigating South East Water over the outages which have plagued customers in Kent and Sussex have been welcomed.

James Wallace, the CEO of River Action, says the move is ‘long overdue’:

“We welcome Ofwat’s investigation, reportedly the first of its kind, though it is deeply ironic that it comes shortly before the government is expected to publish a White Paper to replace water regulators that have consistently failed to hold water companies to account.

“In the case of South East Water, communities across Kent and Sussex have been left without water for days, yet executives continue to be rewarded and customers face sharply rising bills. This investigation is long overdue, but it also highlights a regulatory system that has allowed repeated failure to become routine.

“As the government prepares its White Paper on water reform, it must end pollution for profit, fix a broken regulatory system, and put people and rivers before executive rewards.”

Today’s Ofwat investigation into South East Water follows an earlier enforcement case from November 2023 into whether it has failed to develop and maintain an efficient water supply system, which is still ongoing.

Analysts at RBC Capital Markets told clients this morning:

The new enforcement case relates to Tunbridge Wells, which experienced a sustained outage in November and December 2025. Supply problems continued into January 2026, with Storm Goretti causing additional disruptions that left more than 30,000 homes with intermittent supply.

This follows on from the government’s announcement on Wednesday that it would ask Ofwat to review South East Water’s licence.

Bank of England: Lenders expect drop in demand for mortgages

UK banks are expecting less demand for mortgages in the first quarter of the year, a blow to hopes of a pick-up in the property market.

The Bank of England’s latest Credit Conditions Survey has shown that lenders reported a decrease in demand for secured lending for house purchase in the October-December, with a further decrease expected in January-March.

Demand for secured lending for remortgaging was unchanged in Q4, and was expected to increase in Q1.

A flurry of financial results this morning have shown that the UK property sector is in a soft patch, despite the pick-up in optimism among surveyors (see earlier post).

UK housebuilder Taylor Wimpey reported that demand remained ‘muted’, and that uncertainty ahead of the late Autumn Budget impacted sales through the second half of 2025.

Jennie Daly, chief executive at Taylor Wimpey, told shareholders:

The Government’s planning reforms have been welcome, and we’ve seen increased momentum in our recent planning permissions. However, while affordability is slowly improving, demand continues to be muted - particularly among the important first time buyer category - which will constrain overall sector output.

The company built more homes than a year ago; total completions rose to 11,229, up from 10,593 in 2024. But its net private sales rate slipped slightly.

Shares in Taylor Wimpey have dropped by 3.4% in early trading.

London-focused estate agent Foxtons has reported that its sales slowed in the second half of last year, due to the Autumn Budget and broader economic uncertainty. Its shares are down 3.8% this morning.

Estate agency Savills has also reported that budget uncertainty hit demand, telling investors this morning:

2025 was characterised by a continuation of the market recovery seen in Q4 2024 into Q1 2025, followed by a pause in Q2, which continued into Q3. During this period, both investors and occupiers digested the implications of, in particular, the imposition of US tariffs, alongside other unforeseen geopolitical and fiscal events.

In the UK, the Group’s largest market, heightened uncertainty surrounding the delayed Autumn Budget had a similar subduing effect, particularly on the prime residential market.

Savills’ shares have jumped by 5.7% this morning, after predicting that it will at least match expectations for 2025, with solid year on year growth.

UK construction sector 'having a shocker' after worst slump since early 2023

Britain’s construction sector has suffered its worst quarterly slump in over two and a haf years.

The Office for National Statistics estimates that construction output decreased by 1.1% in the three months to November 2025 compared with the three months to August 2025.

This is the largest three-monthly fall in construction output since March 2023, suggesting demand cooled sharply since last summer.

The ONS says:

Both new work and repair and maintenance decreased by 1.0% and 1.1%, respectively. Within new work, the largest negative contributor came from private commercial new work, which fell by 4.5%. In repair and maintenance, the largest negative contributor came from private housing repair and maintenance, which fell by 3.7%.

Analysts at ING say “Construction output is having a shocker”, telling clients:

It’s easy to blame the Budget in late November for delaying projects and the surveys suggest that was the case. But we doubt that explains everything; new work across housing and commercial property is slumping.

And this is a sector that should in theory be benefiting the most from lower interest rates. On housing at least, we aren’t looking for an imminent turnaround. The impact of past rate hikes is still feeding into the mortgage market, given the prevalence of five-year fixes.

Accountancy and tax consultancy boosted activity in November

Accountants and tax experts had a busy November, boosting growth, as their clients tried to prepare for the budget.

The ONS reports that accounting, bookkeeping and auditing activities, and tax consultancy, drove growth in the ‘professional, scientific and technical activities’ sector in November.

The UK’s stronger-than-expected growth in November is fanning away fears that the economy shrank in the October-December quarter.

Thomas Pugh, chief economist at audit, tax and consulting firm RSM UK, suspects the economy stagnated in Q4, saying:

“The 0.3% m/m rebound in output in November, along with the upward revisions to the monthly data, mean the risk that the economy outright contracted in Q4 has sharply receded.

However, we doubt the economy did little more than stagnate in Q4, as the initial data for December has been weak, and doctor’s strikes will add to the drag on growth. Things should pick up in Q1 of this year though, as activity postponed ahead of the budget comes through, and the impact of strikes and the Jaguar Land Rover (JLR) cyber-attack fades.

“The stronger-than-expected outturn in November will also further dent any chances of a back-to-back rate cut in February. We doubt the next rate cut will come until April.

The money markets indicate there’s just a 7% chance of a rate cut in February, with a cut not fully priced in until June.

Ofwat opens new investigation into South East Water over supply outages

England’s water regulator has opened a new investigation into South East Water, after households and businesses in Kent and Sussex suffered repeated outages.

The investigation will consider whether South East Water has complied with its obligation to provide high standards of customer service and support for its customers.

Lynn Parker, Ofwat senior director for enforcement, says:

“The last six weeks have been miserable for businesses and households across Kent and Sussex with repeated supply problems. We know that this has had a huge impact on all parts of daily life and hurt businesses, particularly in the run up to the festive period. That is why we need to investigate and to determine whether the company has breached its licence condition.”

The move comes after environment secretary, Emma Reynolds, called on Ofwat to review the company’s operating licence. If it were to lose it, the company would fall into a special administration regime until a new buyer was found.

My colleague Helena Horton visited Tunbridge Wells this week, and found schools have shut, businesses have closed, pubs and restaurants shut their doors. Some residents have had almost no water for a week, and have been collecting bottled water from the local rugby club.

David Hinton, the chief executive of South East Water, has been criticised for failing to appear in public during the crisis; he’s paid a base salary of £400,000 and received a bonus of £115,000 last year.

Something I found upsetting re the lack of SE Water senior leadership is that it was left to a v junior employee, a nice young man, to face brunt of public anger & apologise to them at water site. He seemed to be getting little info from HQ. He’s facing the public & CEO is not

— Helena Horton (@horton_official) January 14, 2026South East Water has blamed recent freezing weather for creating leaks in its ageing pipe network; it has a statutory duty to maintain a sufficient supply of wholesome water to their customers.

February interest rate cut less likely

With the economy returning to growth with some aplomb in November, there’s less pressure on the Bank of England to lower interest rates.

Suren Thiru, ICAEW Economics Director, predicts the economy grew in the final quarter of 2025, despite the flu season.

Thiru explains:

“These figures confirm an unexpectedly upbeat November for the economy, as most sectors seemingly shrugged off pre-Budget uncertainty, though were flattered somewhat by the uplift to manufacturing from Jaguar Land Rover’s return to production.

“November’s uptick means it’s inevitable that the UK economy grew modestly across the final quarter of 2025 with easing uncertainty post-Budget likely to have supported growth in December, despite the ‘super flu’ disrupting activity in sectors like education.

“This return to growth probably won’t trigger a sustained economic revival with softer consumer spending amid an intensifying tax burden and higher unemployment likely to mean noticeably weaker growth for 2026, despite a boost from lower inflation.

“These figures make a February interest rate cut less likely by giving those rate-setters still concerned over inflation with sufficient comfort over economic conditions to delay voting to ease policy again.”

2 hours ago

3

2 hours ago

3