UK interest rates should be cut more this year, says Bank of England policymaker

Richard Partington

Interest rates in the UK should be cut further this year amid predictions for a sharp slowdown in inflation, a senior Bank of England policymaker has said.

According to Alan Taylor, an external member of the Bank’s monetary policy committee, cooling energy prices and measures to cut living costs in Rachel Reeves’s autumn budget should help to get inflation back to its 2% target by mid 2026.

As a result, the rate-setter thinks borrowing costs could be cut. He said:

Interest rates should continue on a downward path, that is if my outlook continues to match up with the data, as it has done over the past year.

In a speech in Singapore this morning, Taylor focused on the risks to global trade from Donald Trump’s tariff wars and mounting geopolitical tensions - but gave an unusually upbeat assessment.

Over the long arc of history, he says, the tendency is for trade barriers to be broken down. And despite current tensions, there is still capacity for global trade to accelerate; powered by AI technologies and the ascent of developing nations.

This should help to keep inflation low over the long-term, including in Britain, he says. Taylor suggests the UK has seen a significant influx of cheaper goods as tariff policies lead to the diversion of trade, helping to lower inflationary pressures.

This is a subject we wrote about recently here, amid a flood of Chinese imports to the UK.

As well as this, Taylor says headline UK inflation should fall sharply from the current rate of 3.2% close to 2% by mid-2026. He said:

Tax and administered price hikes will fall away in April, new Budget measures will then lower inflation by an estimated 0.5 percent, food inflation has fallen materially, and energy prices have stabilised at lower levels.

Taylor has been a prominent dove on the MPC as a consistent advocate of rate cuts. He reckons all this is enough to justify further reductions in Bank rate from the current level of 3.75%.

He said:

I see this as sustainable, given cooling wage growth, and I now therefore expect monetary policy to normalise at neutral sooner rather than later.

City investors agree - with markets currently pricing in at least one more quarter-point cut this year.

Key events Show key events only Please turn on JavaScript to use this feature

Big US banks have started to report their earnings before the market opens on Wall Street.

Bank of America shares up by about 1% in pre-market trading, and Citigroup shares are poised to rise by 0.6%, after both banks beat profit estimates for their fourth quarters.

Meanwhile Wells Fargo has slipped 2.5% in pre-market, after it missed estimates in its fourth quarter. Its net interest income (the difference between what it earns on loans and pays on deposits) rose 4% year-on-year to $12.33bn, below expectations of $12.46bn.

That was partly because the bank spent $612m on severance as part of a plan to cut back costs, with thousands of people losing their jobs. It took the bank’s total expenses to $13.7bn.

Last month chief executive Charlie Scharf said he expected more job cuts in the fourth quarter as the bank lowered its cost base. The bank had about 211,000 employees at the end of September, but ended the year with about 205,000.

FTSE 100 touches another record high

The FTSE 100 touched another record today, rising to as high as 10,177.8, as a rally in the metals market buoys London’s listed miners.

The blue chip index is now trading a bit lower at 10,176.05, but is still up 0.38% so far today.

Endeavour Mining is leading the pack with its shares up by more than 4%. Miners Glencore, Fresnillo, Rio Tinto and Antofagasta are all in the top 10 risers so far.

Susannah Streeter, a strategist at the investment service Wealth Club, said the FTSE has had another “power surge”.

Mining stocks are again topping the leader board as precious metals prices hit fresh records. Gold’s allure seems to have no bounds as it climbed to new heights. It surpassed $4,630 an ounce, partly lifted by expectations the US Federal Reserve will opt for more rate cuts as underlying inflation appeared to be a little more in control.

There is no doubt that safe-haven demand is still a big driver, with investors still hugely sensitive to fractious geopolitics and the independence of the Fed coming under threat. Silver has also hit record levels amid ongoing industrial demand around the world and as a safe-haven asset.

Silver, which started 2025 below $30, is now trading at above $90 per ounce.

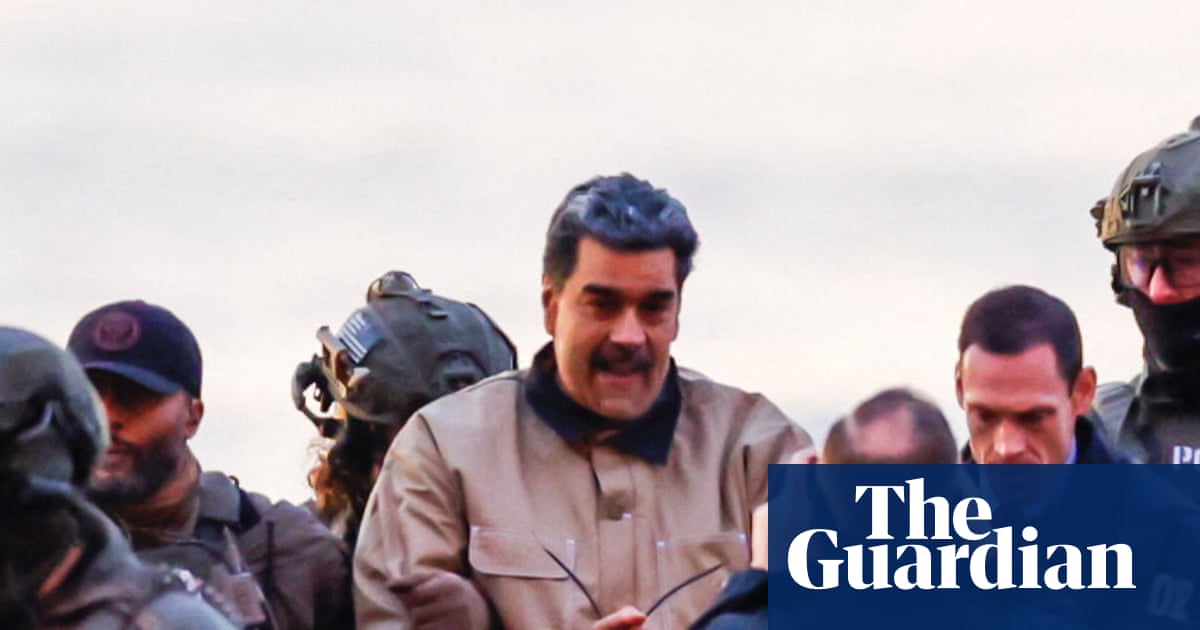

Investors have flocked to precious metals such as gold and silver, viewed as relatively safe assets, after attacks on the Federal Reserve by Donald Trump, his capture of Venezuela’s leader, his threats to take Greenland, as well as violent protests in Iran. Industrial metals have also performed strongly, including copper, a crucial metal for the renewable energy industry.

Kathleen Brooks, research director at XTB, said:

A more interventionist Donald Trump who is pressuring the Fed, demanding corporations do as he wishes and plans to take Greenland are all driving flows into the relative safety of gold, however, zinc, copper, tin and aluminium have now joined the party.

This is a sign that the market considers global growth to be solid, even with the geopolitical waves caused by the Trump administration. US inflation remains stable, and retail sales are expected to come in on the strong side later today.

Metal trading volumes have been particularly strong in China, where speculative traders have piled into commodities such as nickel, tin and lithium.

Guinness prices set to increase by 4p per pint

Shane Hickey

Guinness drinkers will see the cost of their pint rise soon after Diageo announced an increase in prices.

The drinks giant announced that the wholesale price of Guinness will increase by 4p per pint from April 1, blaming the rising cost of its supply chain.

Diageo also announced that a 70cl bottle of Smirnoff will go up by 13p. Some products have escaped price changes, including Guinness 0.0, Guinness Microdraught, Guinness Draught in a can and Baileys.

The average price of a pint of Guinness in the UK is £5.21, according to Diageo. It will be up to publicans to decide on how the new wholesale price rise will affect the price that drinkers pay at the bar.

A Diageo spokesperson said:

Like all businesses, Diageo must carefully manage the rising cost of doing business through regular pricing review of our products.

We have kept today’s cost price increase to a minimum, reflecting the rising costs in our supply chain. This increase allows Diageo to continue investing in our brands to bring high-quality stout and spirits to market, and to support investment in initiatives to drive mutual growth for our customers across the hospitality sector.”

This week it was reported that Diageo’s new boss, Dave Lewis, is considering selling off its Chinese assets to trim down its portfolio. The company is struggling with the impact of Donald Trump’s tariffs, high debt levels and consumer shifts, as many younger people choose to drink little or no alcohol. In November, it flagged a double-digit sales decline in China.

Economic conflict is biggest global risk, WEF survey suggests

Economic conflicts between major powers are the greatest risk facing the world over the next two years, according to experts polled ahead of next week’s Davos summit.

Among 1,300 business leaders, academics and civil society figures surveyed by the World Economic Forum (WEF), “geoeconomic confrontation” was identified as the most pressing threat.

These clashes were cited by 18% of respondents. With war still raging in Ukraine, “state-based armed conflict” was the second most-common risk identified at 14%. Extreme weather events was third, chosen by 8% of respondents.

The warning came after a year marked by Donald Trump’s aggressive tariff policy, and follows US military action in Venezuela, which the president acknowledged was aimed at securing the country’s oil resources.

You can read the full story by Heather Stewart here:

Netflix planning to switch to all-cash offer to seal $83bn Warner Bros deal - reports

Netflix is reportedly preparing to switch to an all-cash offer to seal its takeover of the studios and streaming businesses of Warner Bros Discovery (WBD), as it tries to speed up the deal and fend off a rival hostile bid from Paramount Skydance.

The changes to Netflix’s $83bn (£62bn) offer, first reported by Bloomberg, are designed to accelerate the acquisition, which is expected to take months to conclude, and make it more palatable for WBD shareholders.

You can read the full story by my colleague Joanna Partridge here:

Shares in WBD rose by about 1.6% on Tuesday after the initial report by Bloomberg.

UK interest rates should be cut more this year, says Bank of England policymaker

Richard Partington

Interest rates in the UK should be cut further this year amid predictions for a sharp slowdown in inflation, a senior Bank of England policymaker has said.

According to Alan Taylor, an external member of the Bank’s monetary policy committee, cooling energy prices and measures to cut living costs in Rachel Reeves’s autumn budget should help to get inflation back to its 2% target by mid 2026.

As a result, the rate-setter thinks borrowing costs could be cut. He said:

Interest rates should continue on a downward path, that is if my outlook continues to match up with the data, as it has done over the past year.

In a speech in Singapore this morning, Taylor focused on the risks to global trade from Donald Trump’s tariff wars and mounting geopolitical tensions - but gave an unusually upbeat assessment.

Over the long arc of history, he says, the tendency is for trade barriers to be broken down. And despite current tensions, there is still capacity for global trade to accelerate; powered by AI technologies and the ascent of developing nations.

This should help to keep inflation low over the long-term, including in Britain, he says. Taylor suggests the UK has seen a significant influx of cheaper goods as tariff policies lead to the diversion of trade, helping to lower inflationary pressures.

This is a subject we wrote about recently here, amid a flood of Chinese imports to the UK.

As well as this, Taylor says headline UK inflation should fall sharply from the current rate of 3.2% close to 2% by mid-2026. He said:

Tax and administered price hikes will fall away in April, new Budget measures will then lower inflation by an estimated 0.5 percent, food inflation has fallen materially, and energy prices have stabilised at lower levels.

Taylor has been a prominent dove on the MPC as a consistent advocate of rate cuts. He reckons all this is enough to justify further reductions in Bank rate from the current level of 3.75%.

He said:

I see this as sustainable, given cooling wage growth, and I now therefore expect monetary policy to normalise at neutral sooner rather than later.

City investors agree - with markets currently pricing in at least one more quarter-point cut this year.

Rachel Reeves says 'more temporary support' coming for pubs

Chancellor Rachel Reeves has said pubs will receive “more temporary support” , after backlash over the impact of an upcoming rise in business rates.

She told BBC Breakfast:

There’s a number of things happening with business rates. There’s been a revaluation of the value of properties. This is the first one since the pandemic. So rateable values were going to go up.

And there’s a gradual withdrawal of some of the temporary support that went in during Covid.

Now we’ve put in another £4.3 billion of additional support to phase that transition, but we do recognise that for some pubs there is still a big increase, and so we’re working pretty intensely at the moment. Again, I want to make sure that we get this right.”

An announcement will come “in the next few days and weeks”, she added.

The potential U-turn comes as the chancellor faces immense pressure from the hospitality industry over the rise in business rates.

The sector has faced several challenges in recent years, including higher employer national insurance contributions, rises in the minimum wage, energy costs and inflation. Pubs also face an inflation-linked rise in alcohol duty from next month.

The Times reported yesterday that Reeves could announce a support package for pubs this week, although ministers are still consulting lobby groups and the details of the policy have likely not been finalised.

But it reported that the policy, which is focused on supporting pubs, could be worth roughly £300m.

However, the focus on pubs could trigger backlash from hotels, leisure and other retail firms who will still be affected by the business rate change.

Prudential names HSBC veteran Douglas Flint as new chair

Prudential has named Sir Douglas Flint, the former chair of HSBC, as its new chair, as it deepens its focus in markets in Asia and Africa.

Flint will succeed Shriti Vadera, a former investment banker and Labour business minister, who has been in the role for six years.

Flint, 70, spent more than two decades at HSBC as group finance director from 1995 to 2010 and then as group chair from 2010 until 2017. He will join the board of the insurer as a non-executive director and chair designate in March.

He said:

Being able to help shape the next stage of Prudential’s development is a great privilege and I look forward to working together with the board, Anil, and the whole team to deliver great experience to customers, and real value to shareholders and wider stakeholders. This is such an exciting time to be joining. The business is well placed to meet the needs of our customers and to expand the provision of protection, health and savings solutions to currently under-served markets.”

Prudential, which is listed in both London and Hong Kong, is one of the oldest insurers in Britain, although its presence in the UK became much smaller after it spun off M&G in 2019.

Some of its biggest markets now include Hong Kong and mainland China, and it has a presence in smaller emerging markets in other parts of Asia and Africa.

Flint’s appointment places him on a parallel track with his HSBC successor Mark Tucker, who was named non-executive chair at Prudential’s rival AIA last year.

Prudential’s chief executive Anil Wadhwani said:

Douglas brings extremely valuable expertise to the Board and his deep knowledge of Asia is particularly important for the Company. I look forward to working with him to shape the next phase of Prudential’s growth. I am personally deeply grateful for Shriti’s leadership, counsel and support in the last few years.”

Coca-Cola abandons Costa Coffee sale - reports

Coca-Cola has scrapped plans to sell Costa Coffee after bids from potential suitors came in lower than expected, according to the Financial Times.

It reported that Coca-Cola ended talks with bidders for Costa in December, ending an auction process that had attracted a range of private equity investors and lasted several months.

Coca-Cola had high hopes for the Costa brand when it bought it in 2018 from Whitbread, owner of the Premier Inn hotel chain, for £3.9bn. However, the chain has struggled with rising costs, not least the rise in coffee bean prices, and increased high street competition. Multiple reports suggested that Coca-Cola had been seeking a valuation of about £2bn for Costa in recent talks.

Costa has more than 2,000 outlets and about 18,000 employees in the UK alone. However, as well as rising costs it has faced competition from upmarket rivals, such as Pret a Manger and Gail’s.

Costa turned over £1.2bn in its 2024 financial year, according to the most recent annual accounts filed at Companies House, up just 1% on the previous year. However, its operating loss more than doubled to £13.5m, which it blamed on weak footfall and tougher competition.

Costa, which was founded in 1971 by Italian brothers, Sergio and Bruno Costa, was sold to Whitbread for £19m in 1995. When Coca-Cola bought the business, chief executive James Quincey said there were “great opportunities for value creation”.

Quincey, the British boss of the fizzy drinks company, is preparing to move into the role of executive chairman this year. He will be succeeded by Henrique Braun, Coca-Cola’s chief operating officer, in March.

Coca-Cola and Costa were approached for comment.

BP warns of $4bn - $5bn in writedowns in energy transition business

BP has warned it faces writedown charges between $4bn and $5bn (£3.7bn), mainly in its energy transition business, as it pivots its strategy back to oil and gas.

In a brief trading statement, the FTSE 100 energy company said the multi-billion dollar charges were “primarily attributable to the gas and low carbon energy segment” of its business.

It comes as BP scales back its clean energy projects as part of a “fundamental rest” of its strategy, first announced by its former chief executive Murray Auchincloss last year.

Last month the company made the surprise announcement that it was replacing Auchincloss after less than two years in his role. BP appointed Meg O’Neill, the chief executive of Woodside Energy, who will take over in April, with Carol Howle acting as interim boss.

BP also added this morning that expected its oil trading to be weak when it reports in full for the fourth quarter. It has however cut back its net debt, which is expected to be in the range of between $22bn and $23bn at the end of 2025, from $26.1bn at the end of September.

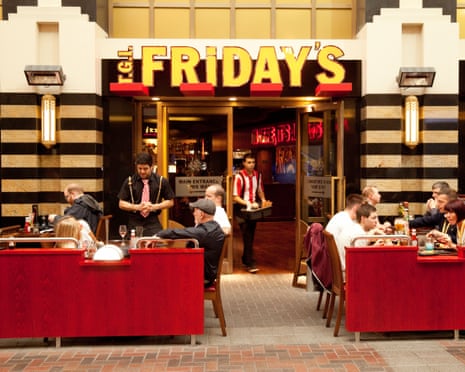

TGI Fridays closes 16 restaurants in administration deal

Sarah Butler

TGI Fridays has closed 16 UK restaurants with the loss of 456 jobs but the casual dining chain will survive with 33 outlets under a company controlled by the brand’s US owner.

Sugarloaf Holdings, a group led by Ray Blanchette a former boss of TGI Fridays who and returned as part of a rescue of the US owner of the global brand in 2025, has bought back the UK business in a pre-pack administration deal. Sugarloaf first acquired the UK business from its private equity owners in October.

The restaurant closures are in Ashton Under Lyne, Doncaster, Staines, Stevenage, Walsall, Bournemouth, Telford, Reading, Coventry, Edinburgh, Crawley, Aberdeen Beach, Nottingham, Sheffield, Stratford and Braintree.

The latest insolvency process for the UK arm comes less than 18 months after the UK business was rescued out of administration by two private equity firms, Calveton UK and Breal Capital, which own upmarket restaurants including Le Pont de la Tour, Quaglino’s and Coq d’Argent. That deal involved the closure of about 35 restaurants.

Ryan Grant and Will Wright, the joint administrators to the UK restaurant chain said the latest rescue deal announced on Tuesday would safeguard 1,384 jobs.

Grant said:

While these have been difficult times for hospitality operators generally, this marks a pivotal step in TGI Friday’s wider turnaround plan, putting in place stable foundations upon which it can begin to move forward.”

Phil Broad, the global president of TGI Fridays, said:

We have been working closely to explore all available options for securing the long-term future of TGI Fridays in the UK, and believe that this is the best outcome for the business, preserves jobs, and offers a strong platform for success and growth.

TGI Fridays has a long history in the UK, and I believe that the future of the brand is in strong hands - focused on reinvigorating the brand while continuing to deliver the bold flavours, welcoming atmosphere, and high-energy dining experience that define TGI Fridays.”

TGI Fridays was founded by the restaurateur Alan Stillman in New York in 1965 as the world’s first casual cocktail bar and restaurant, and now has 360 restaurants in 40 countries, many of which are run by franchisees.

The Dallas-based bar and grill chain has been struggling both at home and abroad with about half its company-owned US locations closing during insolvency proceedings there in 2024.

Blanchette, who ran TGI Fridays parent company in the US for five years until 2023, returned in January 2025 to lead a rescue deal.

TGI’s difficulties in the UK come amid heavy pressure on the hospitality industry from rising costs of labour, energy and tax as well as lacklustre consumer spending. Households have been reining in spending on nights out amid high inflation on essential bills.

Biggest expansion in wind farms 'breakthrough moment' for clean power by 2030

The industry is hailing the bumper offshore wind auction as a breakthrough moment for the UK’s ambition for clean power by 2030.

Dr Douglas Parr, policy director for Greenpeace UK, said:

The North Sea may be running out of gas, but it won’t be running out of wind any time soon. It is the best fuel to reduce the high energy prices gas companies have inflicted on UK homes. With new wind being cheaper than new gas, new nuclear or new biomass plants and lowering prices in electricity and gas markets, this auction keeps the clean power 2030 target, the government’s most ambitious climate commitment, on track.

“These new wind farms will lower our bills when they come online, and shield us against the volatile fossil fuel prices driven by the actions of unreliable petrostates.

He added the government should act further by increasing investment in ports and crucial infrastructure that wind developers rely on, as well as reducing the cost of borrowing through loan guarantees.

James Alexander, chief executive of the UK Sustainable Investment and Finance Association, said:

The results of the government’s offshore and floating offshore wind auction represent a significant step forward in delivering the UK’s evolution to clean energy.

This has the capacity to attract billions of pounds of private capital into our low-carbon industries, supporting long-term growth and jobs across the UK economy. It is also a vote of confidence in the Contracts for Difference model as a crucial driver of investment in our energy system.

Sustained progress will depend on future allocation rounds delivering the scale and consistency needed to accelerate the rollout of renewable infrastructure. The government’s support for credible clean energy policies remains crucial for ensuring the UK’s attractiveness as an investable market.”

Jess Ralston, an energy analyst at the Energy and Climate Intelligence Unit (ECIU), says this will be a breakthrough moment in the UK’s energy independence, and for stabilising energy bills.

Wind lowered the wholesale power price by around a third last year by squeezing out gas generation, which has a direct benefit on electricity bills. At today’s auction price, it is predicted to pay back a little via levies on bills too.

Every wind turbine we build means we need less gas from abroad as the North Sea continues its inevitable decline, so we’ll be less reliant on the actions of foreign actors like Putin. Once we’ve built British renewables, we don’t need to pay another country for the wind and sun. With jobs being lost from oil and gas in the North Sea for many years, the speedy ramp up of offshore wind is needed to provide new opportunities for workers and communities across the UK.

Analysis by the ECIU has found the average price of electricity traded on day-ahead markets last year was around £83 per megawatt-hour (MWh), but could have been as high as £121 per MWh, without British windfarms limiting the role of gas power plants in setting prices.

Introduction: Trump says JP Morgan boss ‘wrong’ over Fed defence

Good morning and welcome to our rolling coverage of business, the financial markets and the world economy.

President Donald Trump has hit out at Jamie Dimon, the billionaire boss of JPMorgan, saying he was “wrong” to suggest he was undermining the independence of the US central bank.

He said:

I think it’s fine what I’m doing. And we have a bad Fed person”.

It comes after Dimon, who leads the biggest bank in the US, expressed concern about the investigation into Fed Chair Jerome Powell on Tuesday. The Justice Department has opened a probe into the cost of the renovation of the central bank’s headquarters and Powell’s testimony about the project.

Dimon told reporters on Tuesday he had “enormous respect” for the Fed chair.

He said during an earnings call:

Everyone we know believes in Fed independence. And anything [that] chips away at that is probably not a great idea, and in my view, will have the reverse consequences. It’ll raise inflation expectations and probably increase [interest] rates over time.”

Central banks around the world have also rallied to defend the Fed and its chair.

When asked about Dimon’s remarks, Trump said:

I think he’s wrong.”

Trump also said yesterday he would continue with plans to announce a replacement for Powell, who he appointed in 2018, within “the next few weeks”.

Elsewhere this morning, energy secretary Ed Miliband has hailed a record auction for offshore windfarm contracts in Great Britain.

12 new offshore projects were awarded contracts after ministers increased the amount of funding available to developers to help them deliver their plans without raising bills for consumers.

The funding was awarded to 8.4 gigawatts (GW) of offshore windfarm capacity, or enough to generate clean electricity for more than 12m British homes before the end of the decade. They were awarded a contract price of between £89.49 and £91.20 a megawatt-hour (MWh) in 2024 prices.

Miliband said:

We’ve secured a record-breaking 8.4GW of offshore wind, enough to power the equivalent of over 12m homes. This is the largest amount of offshore wind procured in any auction ever in Britain or indeed Europe.

With these results, we are taking back control of our energy sovereignty. It’s a historic win for those who want Britain to stand on our own two feet, controlling our own energy rather than depending on markets controlled by petrostates and dictators.

It is a significant step towards clean power by 2030. The price secured in this auction is 40% lower than the alternative cost of building and operating a new gas plant. Clean, homegrown power is the right choice to bring down bills for good, and this auction will create thousands of jobs throughout Britain.”

The agenda

-

8:00am GMT: Bank of England’s Alan Taylors speech at the National University of Singapore

-

9:00am GMT: Launch of the World Economic Forum’s Global Risks Report 2026

-

11:00am GMT: Wells Fargo full year results

-

11:45am GMT: Bank of America full year results

-

1:00pm GMT: Citigroup full year results

2 hours ago

4

2 hours ago

4